Driving license

In France, you can drive with your driving license wherever you have passed it during the whole duration of your residence permit, as long as it bears “student” status.

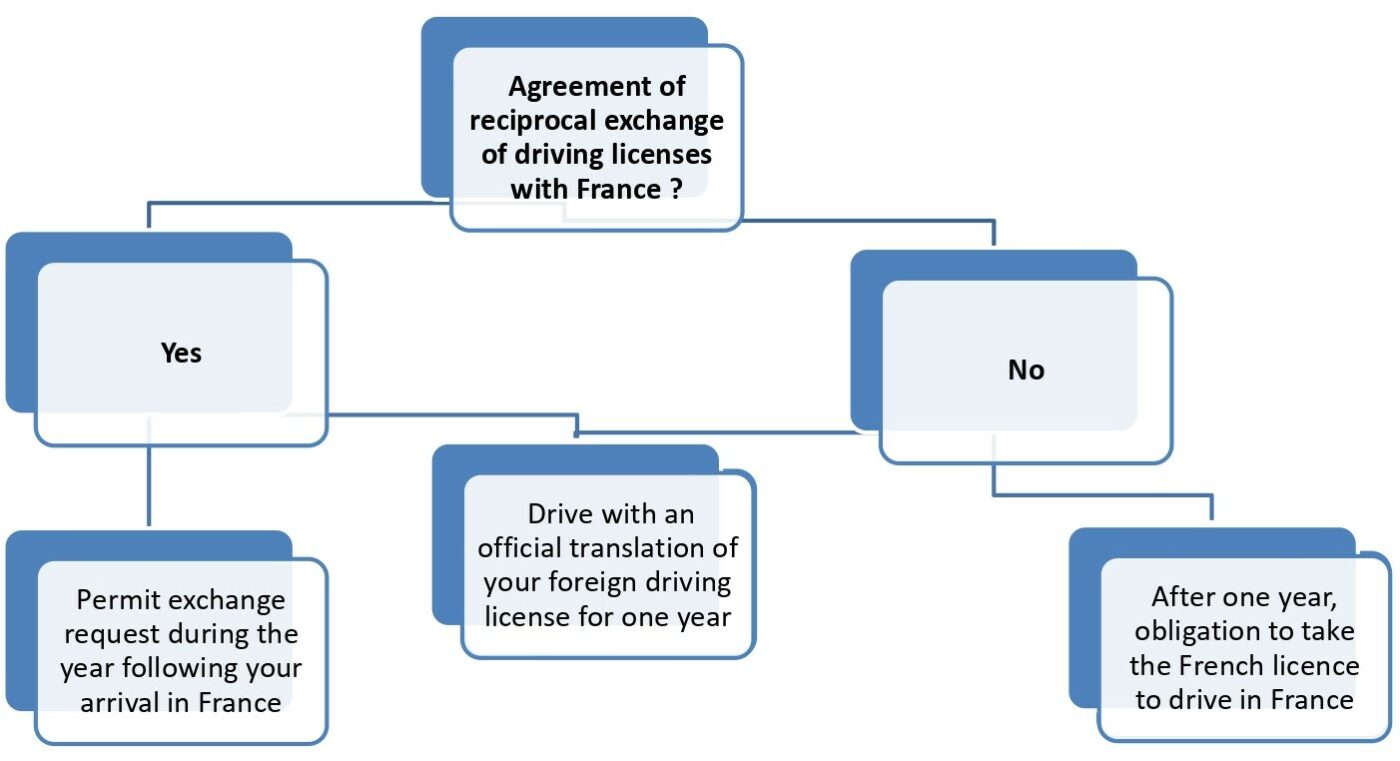

If your visa or residence permit has the mention “Passeport Talent: Chercheur”, “scientifique”, “salarié” or “vie privée et familiale”, you can drive with an official translation (see pages 14 to 19) of your foreign driving license for one year (from the start date of your first residence permit, or the online validation of your VLSTS visa). Beyond that, it is necessary to check if you can apply for the exchange of your foreign driving license for a French one: see on this official website (in the chapter “Conditions à remplir”) the list of the countries which have an agreement of reciprocal exchange of driving licenses with France.

1. If you can exchange your foreign driving license : click on this link “Comment faire la demande?” to find the list of required documents, and the link to the official page to submit your online request, by creating your personal account (on the top right hand side corner). For any question, refer to FAQ page, chapter “Permis de conduire étranger”. The permit exchange request is possible during the year following your arrival in France, from the start date of your first residence permit, or online validation of your VLSTS visa. After this period, it will be too late to request the exchange, you will have to pass the driving license in France: code and conduct. More information here. If you have applied for a driving license exchange for more than 6 months and you have no news, call 34.00 (price of a local call) or 09.70.83.07.07 from Overseas and abroad (non-surcharged number), in order to get an update of your application talking directly with an advisor -in French, ask the help of an French-speaking contact).

2. If the country in which you obtained your license does not have a reciprocal agreement with France : you are allowed to drive for only one year, with an official translation (see pages 14 to 19) of your foreign driving license. Beyond that, you will have to take your driving license in France.

Please note that the international license is valid in France for one year only from your date of entry into French territory. It is not exchangeable for a French license.